Having a sound financial plan can pave the path for a safe and prosperous future, whether it’s saving for retirement, creating an emergency fund, or investing properly.

Technology has made it simpler than ever to manage our accounts and make wise decisions in the digital era.

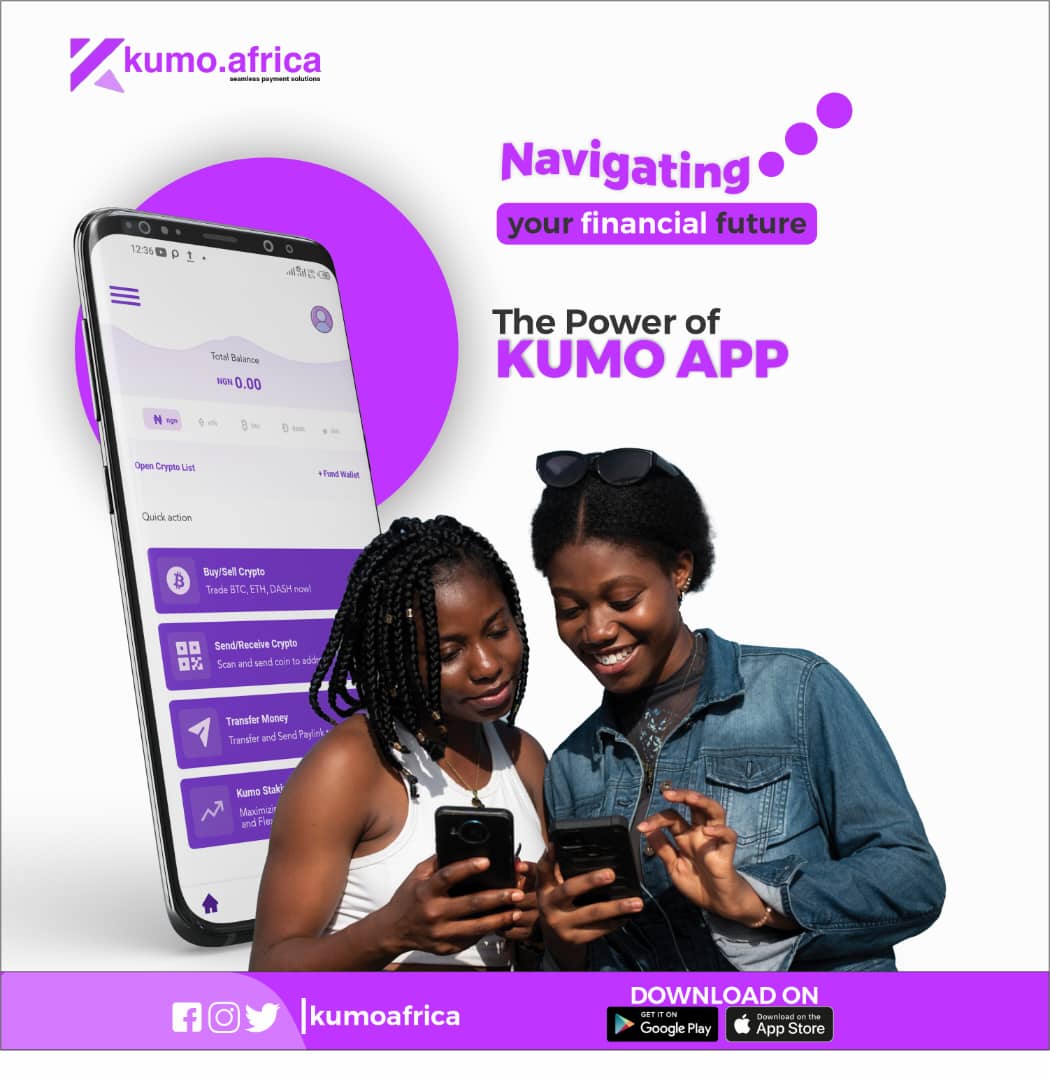

In a wide pool of digital financial tools, Kumo app, a one-stop shop for creating a bright financial future, stands out as one such tool.

Let’s briefly discuss why financial planning is important before getting into the advantages of utilizing the Kumo app.

Importance of financial planning

Building a strong financial foundation

A sturdy foundation that will allow you to withstand any storm can be built by putting a strategic strategy into action. If you don’t have a solid strategy in place, you can find yourself struggling financially or living paycheck to paycheck.

Identifying potential risk

Beyond setting goals, financial planning also entails assessing potential risks and putting plans in place to mitigate them.

You can find potential weak points and take the necessary precautions to protect yourself by doing a thorough risk assessment.

This can entail acquiring insurance coverage, setting up an emergency fund, or diversifying your stock portfolio.

Maximizing saving potential

Planning your finances can help you maximize your ability to save. Whether for immediate necessities or long-term objectives, financial planning motivates you to routinely save a portion of your income.

Adapting to life changes

Financial planning helps you to be ready for unforeseen circumstances and changes in your lifestyle. This can be a job loss, a medical emergency, or the beginnings of a family.

Having a financial plan in place gives you the freedom to adjust to these events without sacrificing your financial stability. During trying times, it enables you to maintain financial management.

Significance of using Kumo app

Easy budgeting

Kumo app makes budgeting simple by offering simple tools to track income and expenses. You can have a comprehensive picture of your financial situation and make wise decisions with the help of customized expenditure categories and real-time updates.

Diverse savings

Setting savings objectives is essential for accomplishing financial success. You can effectively use the Kumo app as a savings platform.

Instead of saving in your regular bank app where you can easily spend the money, you can save in naira and in dollars using the available stablecoins on the Kumo app.

Investment opportunities

Making wise investments is necessary to accumulate money. The Kumo app offers a selection of investing solutions catered to your risk appetite and financial objectives.

You can diversify your portfolio and increase the value of your assets by investing in different cryptocurrencies. Also, you can invest in stable return investments that are available on the app.

Financial Education

To assist you in making wise decisions, Kumo provides useful financial education tools.

You may improve your financial literacy and gain the confidence to take charge of your future by using interactive tools, and articles on personal finance.

Security and privacy

Your financial information’s security and privacy are a top priority for the Kumo app. Your data is safe thanks to strong security procedures and cutting-edge encryption technologies that is used on the Kumo app.

You may simplify your financial path and create a bright future by utilizing the power of the Kumo app. It provides a thorough platform to assist you in navigating your route to financial success, offering budgeting tools, savings objectives, investment choices, and financial education.

With the Kumo app, you have access to a one-stop shop for proficient money management. Kumo app can help you on the road to wealth creation, reaching your objectives, and securing a bright future, regardless of where you are in your financial journey.

Download Kumo app now on Google play store or App Store and start creating the kind of future that you want.